Doing business internationally or working with foreign suppliers inevitably involves managing multiple currencies. This can complicate financial accounting and lead to errors. Gincore software offers a simple and effective solution—a built-in currency conversion feature that helps automate and streamline this process.

This feature is a key element for automating service centers and other businesses, allowing for easy management of multi-currency transactions, saving time, and ensuring full control over finances.

Purpose of the Feature: Why Do You Need Currency Conversion in Gincore?

If your company purchases spare parts from abroad, pays for services from foreign contractors, or accepts payments from customers in different currencies, you know how crucial accurate accounting is. The currency conversion feature in Gincore is designed to solve these exact challenges. It allows you to exchange one currency for another directly within the system, without needing third-party software or manual calculations.

It is an integral part of the comprehensive Gincore accounting module, designed specifically for service centers, repair shops, and retail companies.

Features and Benefits

Using the built-in currency exchange tool provides businesses with several significant advantages:

- Flexible exchange rate management. You can use the default exchange rate offered by the system or set your own, more current rate for each specific transaction.

- Full transaction transparency. Every conversion is recorded in the system as a separate transaction. The transaction history clearly shows the amount debited in one currency and credited in another, as well as any comments on the operation.

- Error elimination. Automating the exchange process eliminates errors associated with human factors in manual calculations.

- Time savings. No more wasting time on calculator computations or reconciling with bank statements for every small transaction. Everything is done in just a few clicks.

- Centralized accounting. All financial transactions, including multi-currency ones, are stored in one place, which simplifies reporting and analysis of the company's financial health.

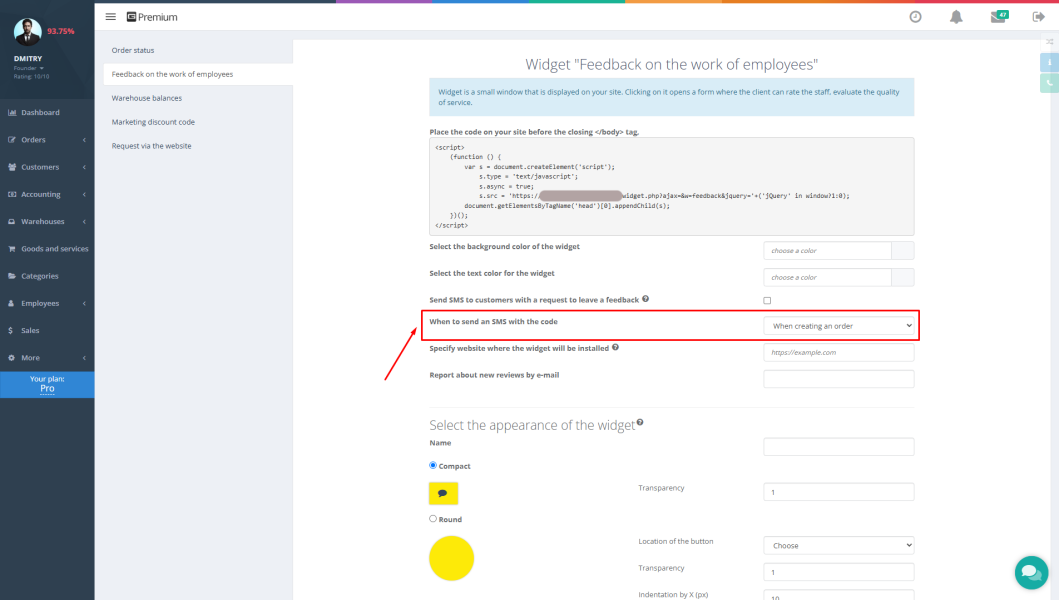

Step-by-Step Gincore Guide: How to Convert Currency?

The conversion process is intuitive and takes less than a minute. Follow this simple guide, based on the Gincore tutorial video.

- Go to the “Accountant” -> “Cash Accounts” menu. This is your financial hub in the Gincore system.

- Select the desired cash account. Find the account containing the funds to be exchanged.

- Click the “Transfer” button.

- Set up the transfer. In the transfer window, select the same cash account as both the sender and the receiver.

- Specify the currencies. Change the currency in the receiver field to the one you want to convert to. For example, if you are exchanging EUR for USD, EUR will remain in the first field, and you will select USD in the second.

- Enter the amount and check the rate. Specify the amount you want to exchange. The system will automatically calculate the final amount in the other currency based on the set exchange rate. If necessary, you can edit the exchange rate manually right in this window.

- Add a comment. This is an important step to maintain accounting transparency. Specify the purpose of the exchange, for example, “Currency exchange for supplier payment.”

- Save the transaction. After clicking the “Save” button, the system will process the transaction. The balance in the cash account will decrease in the original currency and increase in the new currency.

Use Cases

Here are a few scenarios where the currency conversion feature becomes an indispensable tool:

- Settling with foreign suppliers. A service center buys a batch of displays from a supplier in China. The invoice is in USD. The accountant goes into Gincore, converts the required amount from their local currency to USD at the current rate, and records the transaction for future payment.

- Paying a remote employee's salary. A company hires a developer from Europe with payment in EUR. At the end of the month, the required salary amount in USD is converted to EUR at the agreed-upon rate directly within the system.

- Profit consolidation. A retail store accepts payments in multiple currencies. At the end of the reporting period, all revenue is converted into the company's primary currency for easier profitability analysis and financial reporting.

Tips and Life Hacks

- Always leave comments. Detailed comments on transactions (e.g., “Payment for invoice #123,” “Currency purchase for business trip”) will help you and your colleagues quickly understand the transaction history, even months later.

- Set the exact rate. For maximum accounting accuracy, use your bank's rate at the time of the transaction, not the default rate.

- Reconcile regularly. Periodically reconcile the balances in Gincore with the actual balances on your bank accounts to ensure full control over your finances.

FAQ (Frequently Asked Questions)

Where can I see the history of all conversions?

All currency exchange operations are saved in the general transaction list. You can find them in the “Money” section by selecting the desired cash account and period.

Can I set my own exchange rate?

Yes, the system allows you to manually change the exchange rate for each transaction directly in the transfer window.

Can I cancel a conversion transaction?

Like any other financial transaction in Gincore, a conversion can be deleted. However, to maintain accounting accuracy, it is recommended to create a reversing (counter) transaction if an error was made.

Conclusion

The currency conversion feature in Gincore is a powerful yet simple tool that should be in the arsenal of any modern business working with multiple currencies. It ensures accuracy, transparency, and efficiency in financial operations, freeing up your time for more important tasks.

Start using Gincore's currency management features today to simplify your financial accounting and focus on business growth. The automation of service centers and other businesses begins with smart tools from Gincore.

.png)